New to Medicare?

It is very important for everyone becoming eligible for Medicare to get accurate information about coverage and delivery options, including supplemental health insurance, Medicare health plans, and prescription drug coverage. Attention to these issues will help you avoid serious and costly problems later.

Several months before turning 65 you should begin to learn more about Medicare and how it relates to your circumstances. For example:

- If you or your spouse have paid into the Social Security System for 10 or more years, you are eligible for premium-free Medicare Part A (Hospital Insurance) at age 65. If you have paid in fewer than 10 years, you can buy Medicare Part A coverage. Everyone pays a premium for Medicare Part B (Medical Insurance).

- If you have been on Medicare due to disability, you have a brand new six month Open Enrollment Period for purchasing Medicare supplemental insurance when you turn 65.

- Talk to your employer's benefit officer and ask for any information about company health insurance after age 65. If you have an Employer Group Health Plan (EGHP) that will continue to pay secondary after you become eligible for Medicare, study the benefits booklet to find out the cost and benefits of the plan. You will then need to decide if you should keep your EGHP as secondary to Medicare or if you need to drop your EGHP and purchase a Medicare supplement or join a Medicare Advantage Plan. If your EGHP has drug benefits, make sure they are as good as or better than Medicare Part D.

- If you will not be covered by an EGHP plan that will pay secondary to Medicare, begin to investigate other health insurance options - either an individual Medicare Supplement Policy or a Medicare Advantage Plan. SHIIP can provide information about the Medicare Supplement Plans, Medicare Advantage Plans (Part C), and Medicare Prescription Drug Plan (Medicare Part D) options available in North Carolina.

Medicare can be confusing - SHIIP can help

When and How to Enroll in Medicare

Automatic Enrollment

If you are already receiving Social Security benefits, Railroad Retirement benefits, or Federal Retiree benefits, your enrollment in Medicare is automatic. Your Medicare card should arrive in the mail shortly before your 65th birthday. Check the card when you receive it to verify that you are entitled to both Medicare Parts A and B.

Initial Enrollment Period

If you are not eligible for Automatic Enrollment, contact the Social Security Administration at 800-772-1213 or enroll online at www.socialsecurity.gov, or visit the nearest Social Security office to enroll in Medicare Part A and Medicare Part B. You have a seven-month window in which to enroll in Medicare without incurring a penalty. If you’re not automatically enrolled in premium-free Part A, you can sign up for it once your Initial Enrollment Period starts. Your Part A coverage will start six months back from the date you apply for Medicare, but no earlier than the first month you were eligible for Medicare. However, you can only sign up for Part B (or Part A if you have to buy it) during the seven-month time window listed below:

Medicare coverage starts based on when you sign up and which sign-up period, you’re in:

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

Part B (and Premium-Part A): Coverage starts based on the month you sign up:

| If you sign up: | Coverage starts: |

|---|---|

| Before the month you turn 65 | The month you turn 65 |

| The month you turn 65 | The next month |

| 1 month after you turn 65 | The next month |

| 2 or 3 months after you turn 65 | The next month |

During this Initial Enrollment Period, you will also have the option to enroll in a Medicare Prescription Drug Plan (PDP) available under Medicare Part D. Enrollment in a Medicare PDP is strictly voluntary. These plans are offered by private insurance companies approved by Medicare. Information about PDPs can be found on the SHIIP website. If you fail to enroll in a Medicare PDP during your Initial Enrollment Period and you do not have equal or better coverage through an EGHP, you will incur a one percent penalty for each month that you are late enrolling, and you will only be allowed to enroll during the annual Open Enrollment Period of October 15 through December 7 for Medicare Advantage and Medicare Part D.

General Enrollment Period

If you do not enroll in Medicare Parts A and B during your seven-month window of eligibility, you cannot enroll until the General Enrollment Period, which is January 1 through March 31 each year (unless you are entitled to Special Enrollment). Your Medicare eligibility will not begin until the following July 1. Your monthly Medicare Part B premium will increase to include a permanent ten percent penalty for each year of delayed enrollment (unless you are eligible for Special Enrollment):

Currently, you can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. (Starting January 1, 2023, your coverage will start the month after you sign up.) You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Working Past Age 65 (Special Enrollment)

If you or your spouse are actively working at age 65, are covered by an Employer’s Group Health Plan (EGHP) and the company has 20 or more employees, you may be able to delay Medicare Part B coverage without penalty. You will still be eligible for Part A without paying a premium (as long as you or your spouse has 40 credits of work).

- Talk to your employer's benefits officer and ask for information about company health insurance options for people who continue working past their 65th birthday. Ask specifically how many hours you must work to keep your health insurance plan and whether the EGHP will be "primary" or "secondary" coverage to Medicare. Carefully study the company's current benefit booklet to determine cost and benefits of the plan.

- If your EGHP is primary to Medicare, you do not have to enroll in Medicare Part B at this time. You will need to enroll in Medicare Part B within eight months of the EGHP's termination of coverage or when it stops being primary. If your EGHP will be secondary to Medicare despite active employment, you must enroll in Medicare Part B during the seven-month Initial Enrollment Period to avoid future penalties. If you voluntarily disenroll from your EGHP before terminating your employment, you could lose any EGHP benefits when you retire.

- Contact the Social Security Administration at 800-772-1213 or www.socialsecurity.gov or the nearest Social Security Administration office to confirm that you have enrolled in Medicare Part A (Hospital Insurance).

- Give written notice to your company of your intention to continue working past age 65. When you decide to stop working, notify the Social Security Administration immediately. It is also advisable to notify the Social Security Administration that you or your spouse, if covered under your EGHP, will continue to work beyond age 65.

Supplemental Coverage

Medicare is a major federally-funded medical plan that provides a basic foundation of benefits. However, it does not pay 100 percent of all medical bills. Medicare beneficiaries are responsible for premiums, deductibles, and coinsurance. These amounts can be significant. Because of these costs, most beneficiaries need some kind of plan, policy or program to fill in the “gaps.”

Medicare Supplement Insurance

Medicare supplement plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare (Parts A and B). These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health.

Medicare Prescription Drug Coverage (Medicare Part D)

Medicare Prescription Drug Plans (PDPs) are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP – three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDP’s effective date. All people with Medicare are eligible to enroll in a PDP; however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to “Extra Help” through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Employer or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan (EGHP) as retiree health coverage from an employer or the military (TRICARE for Life), you may not need additional insurance. Review the EGHP’s costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

Medicaid or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Other Medicare Insurance Options

Medicare Advantage Plans (Medicare Part C)

Medicare Advantage plans are another health insurance option for Medicare beneficiaries. Medicare Advantage plans (HMOs, PPOs, SNPs and/or PFFS) are available in our state and provide all Medicare Part A and Part B benefits and possibly some extra benefits. Members may be required to utilize a network or group of preferred providers. Check with your health care providers to see if they accept the insurance plan you are considering. All plan options may not be available in the county in which you reside. If you join a Medicare Advantage Plan, you are still in the Medicare Program but you receive your Medicare benefits from the private carrier and are no longer enrolled in Original Medicare. Information about Medicare Advantage plans in North Carolina is available from SHIIP by calling 1-855-408-1212. You may enroll in a Medicare Advantage plan during your Initial Enrollment Period or during the Open Enrollment Period for Medicare Advantage and Medicare Part D from October 15 through December 7.

Call SHIIP for more information

Toll-free 1-855-408-1212

Monday through Friday from 8am to 5pm

The Seniors' Health Insurance Information Program (SHIIP) offers free, objective information about Medicare, Medicare Advantage Plans, Medicare claims, Medicare supplement insurance, Medicare Prescription Drug Plans, fraud and abuse prevention, and long-term care insurance. Trained SHIIP volunteer counselors are also available for one-on-one counseling in every county in the state.

Additional Resources

- Medicare - Call 800-633-4227 or visit www.medicare.gov

- Medicare provides information 24 hours a day, seven days a week about eligibility, enrollment, and coverage

- Social Security Administration - Call 800-772-1213 or visit www.socialsecurity.gov

- Contact the Social Security Administration to enroll in Medicare or to request a replacement Medicare card.

- Your local Department of Social Services (DSS)

- County DSS offices have information about Medicaid, Extra Help, and Medicare Savings Program eligibility and applications.

Medicare FAQs and Information to Consider

Automatic Enrollment:

If you are already receiving Social Security benefits, Railroad Retirement benefits, or Federal Retiree benefits, your enrollment in Medicare is automatic. Your Medicare card should arrive in the mail shortly before your 65th birthday. Check the card when you receive it to verify that you are entitled to both Medicare Parts A and B.

Initial Enrollment Period:

If you are not eligible for Automatic Enrollment, contact the Social Security Administration at 800-772-1213 or enroll online at www.socialsecurity.gov, or visit the nearest Social Security office to enroll in Medicare Part A and Medicare Part B. You have a seven month window in which to enroll in Medicare without incurring a penalty. If you’re not automatically enrolled in premium-free Part A, you can sign up for it once your Initial Enrollment Period starts. Your Part A coverage will start six months back from the date you apply for Medicare, but no earlier than the first month you were eligible for Medicare. However, you can only sign up for Part B (or Part A if you have to buy it) during the times listed below.

Medicare coverage starts based on when you sign up and which sign-up period, you’re in:

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

New: January 1, 2023

Part B (and Premium-Part A): Coverage starts based on the month you sign up:

| If you sign up: | Coverage starts: |

|---|---|

| Before the month you turn 65 | The month you turn 65 |

| The month you turn 65 | The next month |

| 1 month after you turn 65 | In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

| 2 or 3 months after you turn 65 | In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

During this Initial Enrollment Period, you will also have the option to enroll in a Medicare Prescription Drug Plan (PDP) available under Medicare Part D. Enrollment in a Medicare PDP is strictly voluntary. These plans are offered by private insurance companies approved by Medicare. If you fail to enroll in a Medicare PDP during your Initial Enrollment Period and you do not have equal or better coverage through an EGHP, you will incur a one percent penalty for each month that you are late enrolling, and you will only be allowed to enroll during the Oct. 15 through Dec. 7 Open Enrollment Period for Medicare Advantage and Medicare Part D.

General Enrollment Period:

If you do not enroll in Medicare Parts A and B during your seven-month window of eligibility, you cannot enroll until the General Enrollment Period, which is January 1 through March 31 each year (unless you are entitled to Special Enrollment Period). Your Medicare eligibility will not begin until the following July 1. Your monthly Medicare Part B premium will increase to include a permanent ten percent penalty for each year of delayed enrollment (unless you are eligible for Special Enrollment).

Currently, you can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. (Starting January 1, 2023, your coverage will start the month after you sign up.) You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

If you or your spouse are actively working at age 65, are covered by an Employer’s Group Health Plan (EGHP) and the company has 20 or more employees, you may be able to delay Medicare Part B coverage without penalty. You will still be eligible for Part A without paying a premium (as long as you or your spouse has 40 credits of work).

- Talk to your employer’s benefits officer and ask for information about company health insurance options for people who continue working past their 65th birthday. Ask specifically how many hours you must work to keep your health insurance plan and whether the EGHP will be “primary” or “secondary” coverage to Medicare. Carefully study the company’s current benefit booklet to determine cost and benefits of the plan.

- If your EGHP is primary to Medicare, you do not have to enroll in Medicare Part B at this time. You will need to enroll in Medicare Part B within eight months of the EGHP’s termination of coverage or when it stops being primary. If your EGHP will be secondary to Medicare despite active employment, you must enroll in Medicare Part B during the seven-month Initial Enrollment Period to avoid future penalties. If you voluntarily disenroll from your EGHP before terminating your employment, you could lose any EGHP benefits when you retire.

- Contact the Social Security Administration at 800-772-1213 or www.socialsecurity.gov or the nearest Social Security Administration office to confirm that you have enrolled in Medicare Part A (Hospital Insurance).

- Give written notice to your company of your intention to continue working after age 65. When you decide to stop working, notify the Social Security Administration immediately. It is also advisable to notify the Social Security Administration that you or your spouse, if covered under your EGHP, will continue to work beyond age 65.

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

Part A: For most people, Part A does not charge a premium. Typically, Part A pays after your work insurance. Part A probably won’t pay much of the bill, but doesn’t cost anything to have. For that reason, most individuals enroll in Part A at age 65.

Part B: Everyone pays a monthly premium for Part B. Part B typically pays after your work coverage and may not pick up much of the bill. Enrolling in Part B will also start your one-time guarantee to purchase a Medicare Supplement. Once this 6-month time frame starts, it cannot be stopped. For these two reasons, most people wait until their work coverage ends to enroll in Part B.

Part D: Everyone pays a monthly premium for Part D. As long as you have other "creditable coverage," you do not have to enroll in a Part D plan. Creditable coverage means the insurance is as good as, or better than, a standard Part D plan. Check with your HR department to verify if your policy is creditable coverage. Typically, prescription insurance through work (and other sources like VA) offers better coverage than what you can get through Medicare. For this reason, most people wait until their work coverage ends to enroll in Part D.

Medicare Supplement Insurance plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare (Parts A and B). These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health. Information about the Medicare supplement plans sold in North Carolina is available from SHIIP by calling us toll-free at 1-855-408-1212.

Use our free tool to find estimated premium rates.

You will not be auto enrolled into a Medicare Supplement Policy and must make application directly with the insurance company. You will need to contact the insurance company that sells the specific policy you wish to purchase or you may contact an agent who sells the specific policy you wish to purchase. We recommend that you apply at least 30 days before you want the policy to start. If you do not have 30 days, apply as soon as possible. Supplement premiums are paid directly to the insurance company and are not deducted from your Social Security payments.

The Medicare Prescription Drug Plans (PDPs) are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP – three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDP’s effective date. All people with Medicare are eligible to enroll in a PDP; however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans.

For assistance with Part D plan comparisons and enrollments, please call our team of Medicare specialists at 1-855-408-1212 or you may log onto MyMedicare.gov to shop for prescription drug plans available in your area.

If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to “Extra Help” through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Medicare Advantage Plans are health care options provided under Medicare Part C of the Medicare program. These plans are approved by Medicare but sold and serviced by private companies. There are several plan options available under Medicare Advantage such as managed care plans that involve a provider network (HMOs and PPOs) to those that are specially designed for people with certain chronic diseases and other specialized health needs (SNPs) and some that may or may not have a provider network (PFFS) requirement. Most Medicare Advantage plans include Medicare prescription drug coverage.

For assistance with Medicare Advantage Plans comparisons and enrollments, please call our team of Medicare specialists at 1-855-408-1212 or you may log onto MyMedicare.gov to shop for Medicare Advantage Plans available in your area.

To enroll in any Medicare Advantage plan option you must have both Medicare Part A and Medicare Part B. Once you enroll into a Medicare Advantage plan, you will not use your Original Medicare (red, white and blue) card as your Medicare Advantage plan will replace Original Medicare. Instead the Medicare Advantage plan will provide you with a member ID card to use when visiting your medical provider. Please note, you will continue to pay the Medicare Part B premium, and you might also have to pay an additional monthly premium charged by the Medicare Advantage plan.

It is important to remember to check with your healthcare providers before making any change to your Medicare coverage to make sure they will accept the Medicare Advantage plan you are considering.

If you have a limited income, you may be able to get assistance with your health care costs through certain programs:

- Medicaid: If you have a low monthly income and minimal assets, you may be eligible for coverage through Medicaid to pay Medicare costs, like copays and deductibles, and for health care not covered by Medicare, such as dental care and transportation to medical appointments.

- Medicare Savings Programs (MSPs): If you do not qualify for Medicaid but still have problems paying for health care, you may qualify for an MSP, a government-run program that helps cover Medicare costs. There are three types of MSP, and all of them pay the monthly Medicare Part B premium. The Qualified Medicare Beneficiary (QMB) program covers deductibles and coinsurances as well.

- Extra Help: Also known as the Part D Low-Income Subsidy (LIS), this is a federal program that helps pay for some to most of the costs of Medicare Part D prescription drug coverage. You may be eligible for Extra Help if you meet the income and asset limits. Also, in many cases, enrollment in an MSP automatically leads to enrollment in Extra Help.

- State Pharmaceutical Assistance Programs: SPAPs are offered in some states to help eligible individuals pay for prescriptions. Most SPAPs have income guidelines. Many also require you to enroll in a Medicare Part D plan and to apply for Extra Help.

For more information, please see the Get Help Paying Your Medicare Costs page.

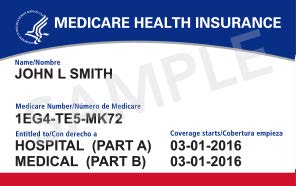

Everyone who enrolls in Medicare receives a red, white, and blue Medicare card. This card lists your name and the dates that your Original Medicare hospital insurance (Part A) and medical insurance (Part B) began. It will also show your Medicare number, which serves as an identification number in the Medicare system. (If you get Medicare through the Railroad Retirement Board, your card will say Railroad Retirement Board at the bottom.)

Source: cms.gov

If you have Original Medicare, make sure you always bring this card with you when you visit doctors and hospitals so that they can submit bills to Medicare for payment. If you have a supplemental insurance plan, like a Medicare Supplement Plan, retiree, or union plan, make sure to show that plan’s card to your doctor or hospital, too, so that they can bill the plan for your out-of-pocket costs.

Note: Medicare has finished mailing new Medicare cards to all beneficiaries. You can still use your old card to get your care covered until January 1, 2020. However, if you have not received your new card, you should call 1-800-MEDICARE (633-4227) and speak to a representative.

If you are enrolled in a Part D plan (Medicare prescription drug benefit), you will use the Part D plan’s card at the pharmacy.

If you are enrolled in a Medicare Advantage Plan, you will not use the red, white, and blue card when you go to the doctor or hospital. Instead, you will use your Medicare Advantage Plan card, which you should receive in the mail. You will also use this card at the pharmacy if your plan serves as your Part D coverage. If you have a supplemental insurance plan, like a retiree or union plan, make sure to show that plan’s card to your doctor or hospital, too, so that they can bill the plan for your out-of-pocket costs.

Your Medicare card, Social Security card, and other health insurance cards are very important documents. Make sure to keep a photocopy of your important identification and insurance cards, write down any important numbers (like your Medicare number), and keep everything in a safe place so that you have a record for future reference if anything gets lost. If your card is ever lost, stolen, or damaged, you can get a replacement card by calling 1-800-MEDICARE (633-4227). You can also order or print a card by logging in to your mymedicare.gov account.

Remember: Do not give your Medicare or Social Security numbers or personal data to strangers. Medicare will never ask for this information over the phone. If you believe you have been the target of Medicare marketing or billing fraud, contact your local Senior Medicare Patrol.

Get answers to your Medicare questions.

Call the Seniors’ Health Insurance Information Program (SHIIP) at 1-855-408-1212 and talk to one of our Medicare specialists. We are here to help Monday through Friday from 8am to 5pm.

We offer free, objective information about Medicare, Medicare Advantage plans, Medicare claims, Medicare supplement insurance, Medicare Prescription Drug Plans, fraud and abuse prevention and long-term care insurance. Trained SHIIP volunteer counselors are available for one-on-one counseling in every county in the state.

Yes, Medicare does cover certain supplies if you have diabetes. Part B covered supplies include blood sugar self-testing equipment and supplies, insulin pumps, and therapeutic shoes or inserts. To get Medicare drug coverage, you must join a Medicare prescription drug plan. These plans typically cover insulin, anti-diabetic drugs, and certain diabetes supplies such as syringes and needles. The Medicare Coverage of Diabetes Supplies and Services booklet provides a comprehensive look what diabetes related services are covered.

Medicare does cover durable medical equipment, which is equipment that serves a medical purpose, is able to withstand repeated use, and is appropriate for use in the home. Original Medicare normally pays 80% of the Medicare-approved amount after you meet your Part B deductible and you are responsible for a 20% coinsurance. Medicare only covers durable medical equipment if your provider says it is medically necessary for use in the home. You must also order the equipment from suppliers who contract with Original Medicare or your Medicare Advantage Plan. If you have a Medicare Advantage Plan, your plan will have its own cost and coverage rules for durable medical equipment. For a more comprehensive list of what is covered, please visit Durable Medical Equipment (DME) section in the "Medicare and You" handbook.